Embarking on the investing journey can often feel like setting sail on the high seas, where bull and bear markets are the unpredictable waves that shape our voyage. Through my own journey, I’ve come to appreciate these cycles not just as market phenomena but as integral chapters in my financial narrative. Let’s dive into the ebbs and flows of these market cycles, informed by data but narrated through personal experience.

The Swells of Bull Markets: Catching the Wave

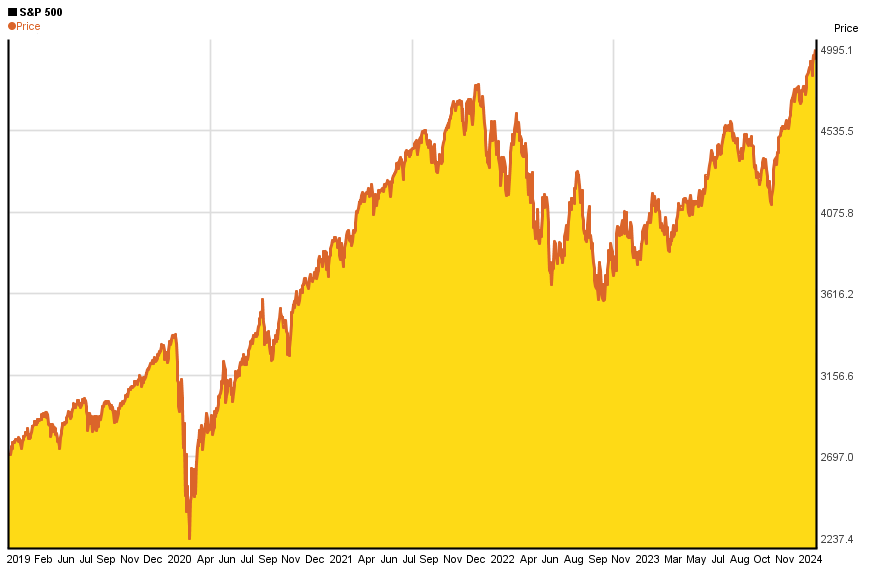

Reflecting on my investment journey, the bull markets have always been exhilarating periods, filled with optimism and growth. Historical data echoes my experiences, showing that the average bull market lasts around 4.5 years, with an impressive average cumulative return of 153%. I recall the post-2009 period, riding the wave of technological innovation that propelled the S&P 500 to new heights. It was a time of learning to harness the momentum, balancing between riding the wave and preparing for the inevitable shift.

The Troughs of Bear Markets: Weathering the Storm

Conversely, bear markets have tested my resolve, demanding a strategic pivot and emotional resilience. Statistically, these periods are shorter, typically lasting about 1.3 years with a median drop of 34%. The rapid descent of the 2020 market amidst global uncertainty was a stark reminder of the market’s volatility. Yet, it was during these challenging times that I learned the most about risk management, the value of a diversified portfolio, and the importance of a long-term perspective.

Navigating with Options: My Tactical Compass

Options trading became my tactical compass during these tumultuous times, offering a strategic toolkit to navigate both the highs and lows. In bull markets, leveraging call options allowed me to amplify gains, while bear markets presented opportunities to employ puts for hedging against downturns. This dynamic approach to options became a cornerstone of my strategy, enabling me to maintain course through varying market conditions.

The Journey of Recovery: Finding Land Again

Every storm subsides, and in the aftermath of bear markets, I’ve witnessed the resilience of the financial markets. The data reveals that recovery times vary, yet the market typically regains its peak within an average of 2 years post-decline. These recovery phases have been moments of reflection and recalibration, allowing me to reassess my portfolio and realign with my long-term objectives.

Conclusion: Embracing the Cycles

My journey through the cycles of bull and bear markets has been transformative, teaching me not just about investing, but about resilience, adaptability, and the perpetual motion of growth and retraction. These cycles are not merely market phases to endure but are integral to the rhythm of the investing world—a rhythm that, once understood, can be harmonized with to achieve financial success and personal growth.